Lyell and ARCH style investing

Address big problems, build world class teams, and catalyze action. The work of Bob Nelsen and the team at ARCH is inspiring and what I believe to be the right way to solve the biggest problems. Recently, ARCH has funded a slew of high impact, high potential companies including Sana, Lyell, Resilience, and now RBNC (really big neuroscience company). These are only the ones recently launched out of stealth; the complete ARCH portfolio is revolutionary.

Investors are in the business of buying risk, and in a market where every investor has been trying to minimize risk and hit singles and doubles, ARCH has doubled down on the strategy of buying risk where others don’t have the capitalization or dynamism to execute. They aren’t just interested in venture creation and seeding companies, but rather seeing them out through to the end. ARCH companies are category defining and are often the ‘every thing we have’ approach, instead of the iterative improvement type technologies that can be the basis of many other companies. The strategy probably wouldn’t have worked in any other time period, but this time period happened a decade earlier in part because of the big bets that ARCH placed (Illumina, Alnylam, Juno, Grail, BlueBird, Beam, etc.). Its cliche at this point, but 21st century innovation in biotechnology has dramatically accelerated the pace of discovery and progress in therapeutics, diagnostics, and tooling. New therapeutic modalities are finally working, and with great effect.

At times, valuations seem like gross over-pays. ARCH companies are inherently hype welcoming and on the public markets, they are buoyed by the reputation of being ‘smart money’. On a pure fundamentals basis, it is hard to justify value, but again these are unique, and possibly permanent market conditions where equities trade more and more on sentiment. Flagship Pioneering now commandeers a similar level of esteem, and similarly their companies are seeded on breakthrough technologies and all-star scientists and managers. ‘Platform’ companies are all the rage and while a good portion of these Flagship and ARCH companies are platform based, my read on why ARCH and Flagship have been successful at pioneering platforms where others have not is in talent. The best ‘platforms’ are teams of brilliant scientists, not necessarily the technology. ARCH wins because they recruit the best scientists.

Separately, there has also been a lot of talk recently about young founder driven life sciences companies. I think there are reasons why such companies could work and clearly the young founder driven strategy works in software. But I’m less convinced that a new wave of young founders will sweep through biotech and biopharma, than those like Jake Becraft and Bay Bridge Bio. Rather, I quite like Bruce Booth’s take, essentially that there are very good reasons why older CEOs and founders are more successful. Building companies in life sciences is hard, and made far easier with the networks, operational experience, and recruiting ability of more seasoned executives. This isn’t to say that companies built by younger founders can’t succeed, simply that it makes sense to be more comfortable with more experienced management.

This is partly why I am so impressed with companies incubated and spun out of ARCH. Immediately, you have access to the best network in biopharma to recruit from and build with. At the end of the day, bio is very hierarchical and your ‘lineage’ matters a lot for better or for worse. Companies spun out of top funds are orders of magnitude more connected and able to attract talent than smaller founder driven companies.

This brings us to Lyell Immunopharma. Seeded by ARCH in 2018, the company brings together world leaders in cell therapy to bridge success in liquid cancers to solid tumors. The company is based in Seattle and San Francisco, and their technology comes out of the labs of Nick Restifo (NCI), Stan Riddell (Fred Hutch), and Crystal Mackall (Stanford). Important to note about the technology is that it arises principally from biological understanding, rather than a tech enabled improvement (ie. it isn’t a cute local delivery tool or even synthetic gene circuits, but rather the company aims at root biological causes of lack of efficacy — mainly exhaustion and lack of durable stemness). True to ARCH style, the company is taking a risk by tackling the root of a hairy problem. Lyell is the authentic culmination of the life’s work of brilliant scientists. The ‘Founder’s Vision’ portion of the S-1 is worth reading. Rick Klausner, the CEO, is someone whose career is worth knowing and frankly its inspiring knowing that giants like this are spearheading the fight against the cancer each and every day.

Lyell reprograms T-cells for solid tumor cell therapy using their Gen-R and Epi-R technologies which loosely just stand for ‘genetic reprogramming’ and ‘epigenetic reprogramming’ respectively. Reprogramming the cells is relatively simple and really anyone can do this; the hard part is knowing exactly how to reprogram them to get the phenotype you want, and this comes from deep expertise in T-cell biology paired with clinical validation. The founders spent their careers doing exactly this, and paired with insights from other giants like Steven Rosenberg, the company has been able to develop a system for optimal reprogramming of patient derived T-cells that addresses the specific problems native to solid tumors.

The Gen-R platform is simpler than it sounds and really only revolves around optimized over-expression of a single protein, c-Jun. The discovery of c-Jun’s role is a story of the strength of hypothesis driven science. Crystal Mackall’s group at Stanford first developed a model of CAR-T cell exhaustion, then did a chromatin structure access study to identify differentially accessible binding sites between exhausted and non-exhausted T-cells. By individually testing transcription factors, their group was able to show that several upregulated transcription factors in exhausted cells were able to be complexed with the c-Jun protein. The rest was pre-clinical testing, as both Dr. Mackall’s group and co-founder Stan Riddell’s group were able to show robust responses in genetically modified T-cells in rigorous solid tumor models. These type of discoveries were made via good old fashioned human intelligence; hypothesis driven science for the win.

The Epi-R platform was developed in a similar manner, except the perturbation of the cells doesn’t involve any genetic reprogramming, simply just media and cytokine growth conditions, and better activation/expansion protocols. Again, there isn’t any way to optimize this without the hard work of brilliant scientists doing basic science research. The discovery of tumor infiltrating lymphocytes (TILs) as a unique solid tumor fighting cell population due to their polyclonal antigen recognition allows them to combat the heterogeneity of solid tumors. However, TILs have seen limited efficacy due to issues of persistence, and difficulties in culture as standard techniques cause loss of TCR diversity. Decades of study and advances in transcriptional profiling have identified certain cell populations and their characteristics, allowing targeted perturbations to develop expansion and activation protocols to match those cell states.

Lyell’s knowledge for how to do this is basically published (the TCF7 transcription factor has been identified to give rise to stem-like T-cell populations) and they give a comprehensive list of relevant publications on their website. The landmark studies describing their work appears most prominently in the following three papers:

- Defining T cell states associated with response to checkpoint immunotherapy in melanoma (Hacohen et al. 2018)

- Stem-like CD8 T cells mediate response of adoptive cell immunotherapy against human cancer (Rosenberg et al. 2020)

- T cell stemness and dysfunction in tumors are triggered by a common mechanism (Restifo et al. 2019)

But we are learning new stuff everyday, and there were two new papers published in Nature just today describing similar work:

- Transcriptional programs of neoantigen-specific TIL in anti-PD-1-treated lung cancers (Yegnasubramanian, Ji, Pardoll, Smith et al. at Johns Hopkins)

- Phenotype, specificity and avidity of antitumour CD8+ T cells in melanoma (Wu et al. at Dana Farber)

Again, this kind of research is great because it is hypothesis driven, blended between clinical and bench researchers, and supported by multiple lines of evidence ranging from in vitro to clinic. The best science is hard work and require the appropriate funding to translate learnings to widespread clinical trials.

Using these two platforms, Lyell has built a T-cell therapy company using TILs, TCR modified T-cells, and CAR modified T-cells. For CARs, they use both Epi-R and Gen-R, but for TILs, they only use Epi-R, and for TCRs, they are advancing programs in Epi-R and Gen-R modified cells separately. The reasoning for using or not using a specific platform probably was resolved during preclinical testing but wasn’t mentioned in any documents. Their initial CAR target is ROR1 and in combination with GSK, their TCR target is against NY-ESO 1. The TILs are polyclonal. All of these are set to start Phase I trials in 2022.

Looking forward, the team at Lyell sees rejuvenation of T-cells with Yamanaka factors as the next frontier. Dr. Klausner wants to address immuno-senescense as a moonshot way of addressing not only the rise of cancer with age, but also autoimmune diseases and susceptibility to infectious diseases. It is well known that the thymus shrinks as we age and phenotypically our T-cells exhibit less stem-ness and are more easily exhausted. These ‘rejuvenated’ T-cells might potentially be used as a maintenance procedure in old age to help sustain immuno-competence or also be used in an Epi-R workflow for specific indications.

If there was a team to do it, if there was technology to do it, Lyell represents our biggest and probably best shot at it and even so the company is a big hypothesis. I’m looking forward to the safety data, especially given the struggles Tmunity has earlier this year, though Lyell has engineered an EGFRopt safety switch into their CAR product. I’d probably also guess that cell therapy using only T-cells will be replaced by combinations of NK Cells, Macrophages, Tregs, etc.

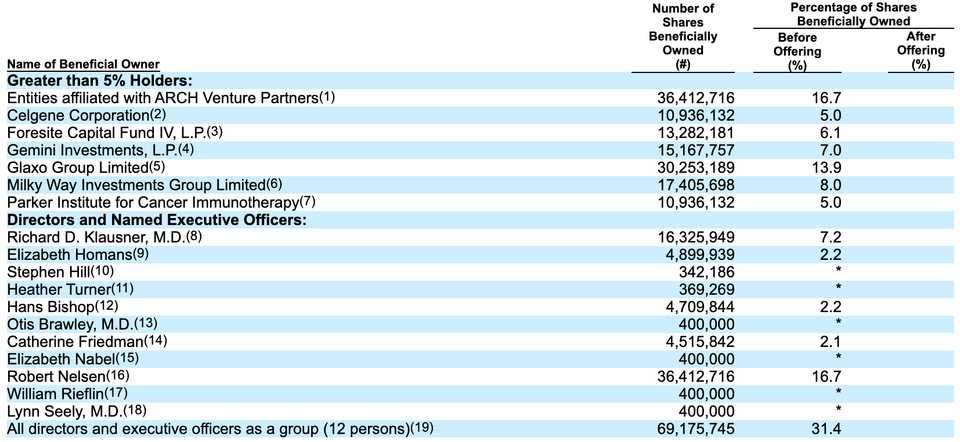

Last interesting point to me about Lyell is the cap table. Bob Nelson - 16.7% of the company. Milky Way Investments Group Limited - 8% of the company (???).

ARCH has built a generation of transformative and lasting life sciences companies, and Lyell is the most recent flagship example os it. Building the next Eli Lilly, Pfizer, Novartis, Vertex, or Gilead is a whole other challenge and it will be interesting to see whether these ARCH style companies can gain that level of size. Regardless, the time is now for innovation in biomedicine and we certainly should be applauding taking large bets on biological risk and answering the important questions about our most promising therapeutic candidates.