Neoleukin Therapeutics

Neoleukin is a pre-clinical stage biotech company founded out of the labs of David Baker and Chris Garcia whose mission is to utilize de novo protein design to develop custom protein therapeutics. The science behind the company was published in a landmark Nature paper released in January 2019 titled De novo design of potent and selective mimics of IL-2 and IL-15. Following publication and launch into a company, Neoleukin was quickly acquired/merged with Aquinox Pharmaceuticals for $40 M. Aquinox’s assets were abandoned and sold off and the company was rebranded as Neoleukin with the sole asset being an IL-2/IL-15 receptor agonist with program name NL-201.

The company has the potential to usher in a new paradigm of combination immunotherapy, enabling synergies that level up the capabilities of existing modalities and helping patients and their families. As a public company, the market cap of $NLTX has fluctuated in an effective range of between $200-600 M. The goal of this post is to explore the landscape of Neoleukin’s lead program as well as evaluate its ability to grow as a platform therapeutics company. I own shares.

NL-201

Neoleukin’s lead program is an IL-2/IL-15 mimetic that selectively binds certain subunits of the IL-2 receptor (IL-2R). The molecule is slightly different than the one published (Neo-2/15) as a 40kDa PEG is attached to improve half-life properties. The molecule itself is roughly 25% smaller than WT IL-2 in terms of peptide length, but the addition of the PEG makes it larger than WT IL-2.

Nature has designed human immunology to be highly pleiotropic, context dependent, and combinatorial, allowing a single system to govern almost all aspects of human biology and response to disease. During periods of dysregulation or imbalance such as disease, immunological machinery can misfunction or be evaded. Therapeutics are often blunt instruments that wish to temporarily or constitutively perturb existing systems for homeostasis to restore the body to a state of stable self regulation. While specific proteins or genetic networks can be perturbed using small molecules or gene therapy, drugging an intricate target like the immune system requires orchestration on the cell signaling and receptor level. Neoleukin’s development of cytokine mimetics translates the bluntness of therapeutics into the language of immunology, enabling measured modulation based upon our rapidly accelerated understanding of systems immunology.

Word salad aside, harnessing the immune system for therapeutics purposes has clearly demonstrated value, given the success of monoclonal antibodies and cell therapies. Antibodies and cells are the physical manifestations of cancer killing agents. Cytokines, the molecules that govern how cells communicate and integrate cellular responses, have seen relatively less success. This isn’t due to lack of interest, however. Interferons, cytokines, and chemokines all had their moment (before PD-1, there was IL-2) but due to our limited understanding of their effects and our limited ability to improve and engineer them, their clinical value has been small. Neoleukin is a bet that protein design for the purposes of harnessing cytokines and communication proteins is mature.

Using decades of progress out of David Baker’s lab at the University of Washington and a team of brilliant scientists led by Daniel-Adriano Silva, a de novo computational protein engineering and design platform was developed and was utilized to address the challenges of IL-2 as a therapeutic. The de novo mimetic designed by Neoleukin is more compact, more potent, hyperstable, and most importantly, selective for the exact purposes of cancer immunotherapy with limited pleiotropic effects.

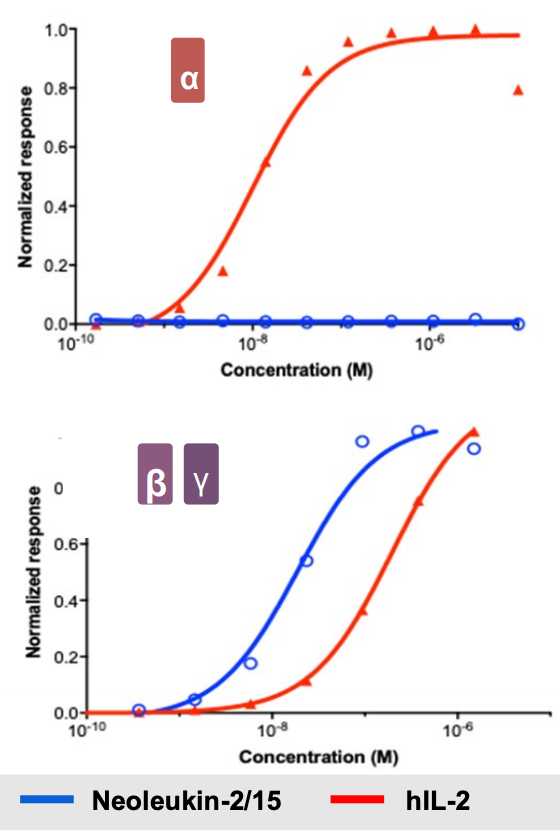

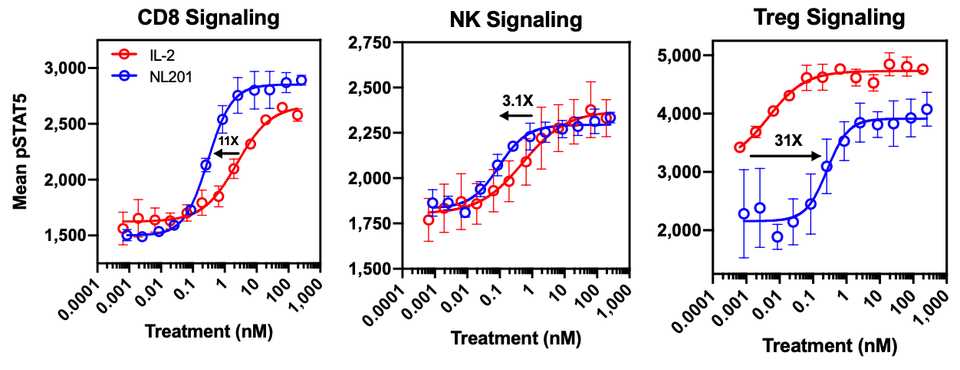

IL-2 is a 15.5-16 kDa protein that is a sort of ‘master regulator’ for immunity and the behavior of white blood cells. Its receptor is heterotrimeric. Expressed on lymphocytes, the conformation can vary based on different combinations of protein structural chains alpha, beta, and gamma. Based on signaling dynamics and cell type, the expression of these three chains is different and can assemble in different combinations (typically trimeric or just beta and gamma) to generate low and high affinity IL-2 receptors. This is useful because it gives regulatory flexibility to a single IL-2 molecule. Instead of having a single IL-2 receptor that is uniformly expressed and responded to, the single IL-2 molecule can now control behavior based on its local concentration as well as which cells are present. As it turns out, IL-2 is a potent activator of lymphocytes including CD8+ cytotoxic effector T cells and NK cells that kill tumors, as well as suppressive Tregs and eosinophils that contribute to vascular leak syndrome. Basic structural biology and immunology work has led to the hypothesis (not settled by any means, however. More on this later) that the alpha subunit (IL-R-alpha) is the chain that contributes most to Treg activation and resultant dose limiting toxicities. NL-201 selectively binds the beta and gamma subunits and also IL-15 which also contributes to activation of CD8+ effector T cells and NK cells.

Selective binding enables selective activation, and compared to WT IL-2, NL-201 is able to demonstrate robust specific activation of the immune cells of therapeutic interest. This is because the trimeric conformation with the alpha subunit has much higher affinity for IL-2 than the dimeric beta and gamma conformation. In fact, low cose IL-2 can be used as an anti-inflammatory autoimmune treatment.

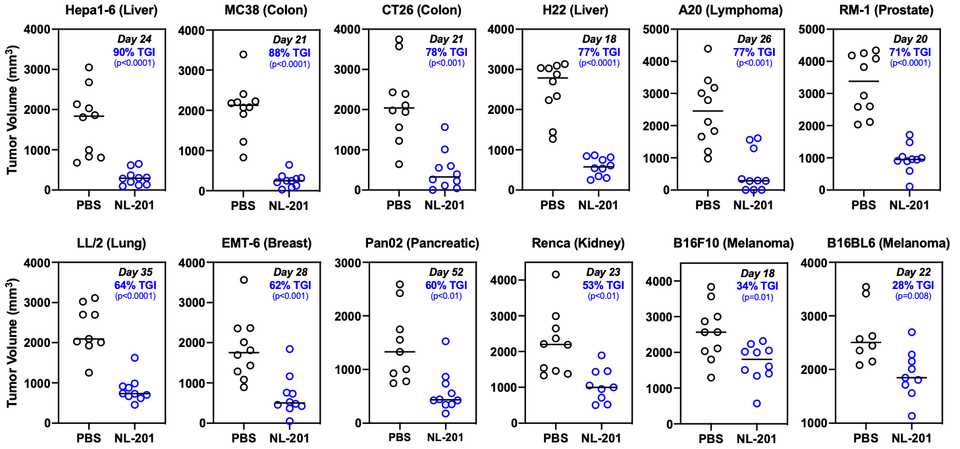

Basic biology in vitro is clearly limited. However, in this case it nicely translates to monotherapy efficacy in vivo in many separate cancers.

Success as a monotherapy is important for any drug candidate but the beauty of harnessing immunology as a therapeutic strategy is synergy. Chronic activation of T cells contributes to anergy and indeed dosing with NL-201 upregulates PD-1 on T cells in a dose dependent manner. However, combination treatment with anti-PD-1 enhances the efficacy of both agents, extending survival in multiple aggressive tumor models. The same poster demonstrates synergies with a tumor targeting antibody, and further work has even demonstrated synergy with CAR-T.

Competitors

Though Neoleukin’s computation de novo design platform is novel, the idea of designing a better IL-2 mimetic is not new. Perhaps the earliest example is Proleukin (aldesleukin), a synthetic recombinant IL-2 developed by Novartis and sold to CliniGen in 2019 for $210 M. Though off patent since 2015, the drug did $60 million in sales in the year leading up to June 2018. The drug is indicated for metastatic RCC and metastatic melanoma but is currently being trialed for a variety of other autoimmune and immuno-oncology indications. In the last couple of years, technology to engineer improved variants of IL-2 has evidently matured and pharma has invested significantly into clinical trials and acquisitions.

The first next generation or ‘better IL-2’ has come in the form of Bempegaldesleukin (NKTR-214) from Nektar Therapeutics. ‘Bempeg’ is essentially a 6x PEGylated version of aldesleukin on which the PEG chains are attached to the IL-2R-alpha binding region of IL-2. The extra PEG moieties expand half-life, and the fully PEGylated molecule acts essentially as a pro-drug, releasing PEG chains over time and generating a prolonged anti-tumor effect. In 2019, Nektar was granted FDA breakthrough designation in combination with Nivolumab, an anti-PD-1 antibody for advanced melanoma (the company signed a $1.85 B licensing deal with BMS to make this happen). The molecule is also currently being evaluated in renal cell carcinoma as well as with several other cancer targeted antibodies in multiple other cancers. The clinical data appears strong so far 123, and the drug is expected to be a blockbuster with a $1.7 B peak sales estimate in 2026.

Next most advanced clinically, there is THOR-707, a synthetic ‘not alpha’ IL-2 developed by Synthorx. The specificity of THOR-707 is received by specifically PEGylating a location on IL-2 that prevents engagement with the IL-2 alpha receptor. The company was acquired by Sanofi in 2019 for $2.5 B and interim clinical data was reported at AACR 2021. AEs included low IL-5 levels, no vascular leak syndrome, AEs included flu-like syndromes, fever, vomiting/nausea, chills, and transiently reduced T cell count. No dose limiting toxicities were observed at 24 ug/kg monotherapy or 16 ug/kg in combination with PD-1 inhibitor Keytruda. The responses were uninspiring however, with just three confirmed partial responses and 2 stable disease out of 28 enrolled advanced/metastatic tumor patients.

On the large pharma side, Roche and Pandion/Merck are both betting on modified cytokine antibody conjugates that allow specific targeting to sites of interest (PD-1 for Roche for T-cell targeting, an antibody fragment for Pandion). Theoretically, this should allow both longer half life, higher dosing potential, and greater activation of cells of interest. Similarly, Asher Bio recently raised $108 M in a series B to do similar IL-2 cis targeting for a variety of indications.

Perhaps the greatest competitor in the immuno-oncology space is Synthekine, which was founded out of Chris Garcia’s lab at Stanford in 2018. Synthekine’s lead program STK-012, preferentially targets the alpha and beta conformation instead of the beta gamma conformation with engineered IL-2 mutants. Their argument is that activated effector T-cells express the trimeric conformation and will outcompete Tregs for the administered drug. Meanwhile, the lack of gamma subunit targeted prevents NK cell activation, which Synthekine believes is responsible for dose limiting toxicities, instead of eosinophils. So far, preclinical data looks stronger even than Neoleukin’s but it remains to be seen what behavior looks like in human clinical trials.

Competition is clearly quite robust, and most have areas where theoretically they earn an advantage. Without clinical data, efficacy is impossible to measure, but in my view there are still reasons to believe in Neoleukin’s approach. Specifically, being a de novo designed molecule provides advantages in stability and potentially leaves behind other issues of the WT IL-2 such as low half life, or potentially other toxicity mechanisms that are less understood. On the other hand, I’m not entirely convinced that immunogenicity is a non-issue so Neoleukin may have issues with high doses, which have catalyzed responses previously with IL-2.

One concerning aspect of competitor clinical trials has been the waning of efficacy through time for ‘not alpha’ cytokines like THOR-707 and nemvaleukin alfa (developed by Alkermes). While these two molecules are not as selective as NL-201, they potentially lend credence to the hypothesis that the not alpha approach may not induce long term remissions 12. On the other hand, bempeg has continued to show promising efficacy in a range of malignancies including recently in first line metastatic melanoma with a 34% CR rate.

Business Operations

From my perspective, Neoleukin clearly differentiates from its competition in terms of platform potential but preclinical differentiation with molecules like bempeg or STK-012 are yet to be seen. Business operations are perhaps another area where question marks remain.

Neoleukin is at this point a sizable company, with 93 employees on LinkedIn, roughly a quarter MDs or PhDs. Daniel-Adriano Silva recently left the company in early 2021 and while the SAB is full of rockstar scientists, the managers are mostly at growth stages of their careers and taking on new roles. This potentially translates to decreased operational risk taking such as not developing manufacturing capabilities in house or not being able to execute on BD deals.

In terms of management of the scientific platform, Neoleukin holds patent protection over the de novo design platform into 2039, offering a large degree of runway to develop assets. A blemish earlier this year was a clinical hold letter from the FDA related to an IND for their Phase I clinical trial. Dated January 7th 2021, the FDA has required Neoleukin to develop an assay to more accurately measure doses of the protein, but this was resolved by the company on April 26th. Speaking of the trial, the Phase I will be as an IV administered monotherapy in patients with advanced, relapsed, or refractory solid tumors with indication specific expansion cohorts for renal cell carcinoma and melanoma. Being conducted in both Australia and North America, target enrollment is up to 120 patients assessing multiple schedules and dose levels for safety, PK, PD, and activity. Interim data is expected in 2022.

From a shareholders perspective, there are 42.3 M shares outstanding (of which UW owns 5% and 12.7 M prefunded warrants. At a current (8/31/21) share price of $8.15, this represents a market cap of approximately $345 M. The company has roughly $164 M in cash as of June 30 2021 (EV: $181 M), which are expected to fund operations into 2023. R&D costs were $25 M in 2020 but are expected to ramp significantly as clinical trials commence. A raise is likely in order soon unless a spur of BD activity develops. While the market for immunotherapy is large and potentially receptive to combination treatment, some of Neoleukin’s competitors are better funded and may be able to execute and get to market quicker.

Future Prospects

To summarize what we have learned so far, Neoleukin has a promising computational design platform that should theoretically be able to design proteins in a manner that is more structure purpose guided, and enabling their scientists to orchestrate immune responses synthetically. There is a clear purpose for why computational design has been useful here, and it clearly separates Neoleukin’s molecules from those developed by other companies, making head to head comparisons difficult and setting up for exciting clinical readouts. However, the competitiveness of the cytokine field and Neoleukin’s traction thus far has somewhat depressed the valuation of the company.

Is Neoleukin’s platform and development worth $181 M? I would argue that the market will answered that question with a resounding yes. If the platform indeed is able to generate proteins that work in humans even at non-inferior levels as bempeg and others, the validation that provides to the platform enables rapid development of new assets. If NL-201 pans out, it may compete with others in a very large market, but still should reach peak sales of at least $181 M if approved. Best case scenario, it is best in class and becomes a pipeline itself with approvals in multiple different indications and in combination with checkpoint inhibitors, cell therapies, and other antibodies and even cytokines.

Worst case scenario, NL-201 gets scrapped and the company looks towards other therapeutic opportunities which are likely already in development. Think other cytokine mimetics, for other indications like autoimmunity, or decoy receptors, or really any other biologically active protein with a predictable structure. Importantly, the platform designs proteins fit for use instead of adapting natural proteins using traditional protein engineering approaches. As a result, the platform may be more effective for developing more complicated protein arrangements like bispecifics or proteins with multiple functional regions. The speed at which this occurs is another technical advantage, exemplified by the company developing an ACE2 mimetic decoy for Sars-CoV-2 that reached animal testing in just 69 days.

Neoleukin does have other technologies mentioned in their corporate presentation including some conditionally active split technology as well as data demonstrating synergy with CAR-T. My perspective is that synergy will become a dominant theme in immuno-oncology and cytokines as a backbone treatment become an attractive collaborator for licensing deals or even acquisitions. Pandion Therapeutics, a preclinical stage company developing IL-2 antibody conjugates was bought out by Merck for $1.85 B and Synthorx mentioned previously was bought by Sanofi for $2.5 B at a similar clinical development stage. Licensing revenues from bempeg have already reached the hundreds of million dollar range. Altogether, Neoleukin sits in a strong niche within the therapeutic development landscape.

Several other articles including this article from c&en, this article from Nature Drug Discovery, and this article from Evaluate Vantage are worth reading and more comprehensive overviews of the IL-2 space.